Our Team

Lower Your Taxes Today

Meet Our Team

Linda Jensen

Since 1994, Linda Jensen has been a licensed professional in the financial services industry. She is the heart and soul behind Heart Financial Group, serving as its founder and CEO. Linda’s commitment to integrity is unwavering, and she holds several certifications, including Certified Exit Planning Advisor, Certified Financial Fiduciary, Chartered Financial Consultant, and Chartered Life Underwriter.

Linda has been sharing her knowledge through financial seminars, educating the public and business owners on a wide range of topics since 1997. As a holistic fiduciary financial planner, Linda always prioritizes her clients’ best interests. She takes pleasure in enlightening clients about all facets of planning, with a special focus on tax planning. Linda’s approach is to present her clients with options, enabling them to make informed decisions based on facts. She is passionate about helping her clients achieve their goals and dreams.

On a personal note, Linda is happily married to her college sweetheart. They are blessed with two children and five grandchildren, and they take pride in calling the Pacific Northwest their home. Linda is a lifelong learner with a love for hiking, reading, cooking, and sewing.

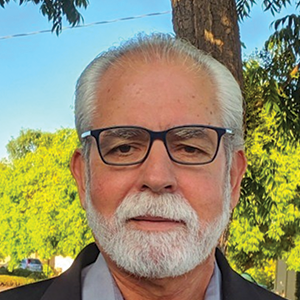

Victor Mojica

Victor is a distinguished partner at CPA Due Diligence and Profits USA. CPA Due Diligence specializes in cost-saving, tax mitigation, and wealth creation solutions tailored to client needs, working in partnership with the client’s existing key advisors.

CPA Due Diligence has sourced experts in the area of tax strategies that purposefully work with exceptional and accomplished top tax attorneys, CPAs, and other experts. They provide audit protection for each strategy they implement. While CPAs typically handle tax return preparation, they generally do not offer tax advice. However, the experts at CPADD are specialists in their field, utilizing unique sections of the tax codes to execute recommended strategies.

Every client situation is unique, and CPADD designs custom plans with the client’s best interests at heart. They offer audit protection with every tax reduction method, giving clients peace of mind that every solution is compliant with IRS codes. The IRS has audited all of CPA Due Diligence’s strategies, and they maintain a flawless record, never having lost an IRS or franchise tax audit.

CPADD has access to unique tax strategies that not only increase profitability for their business clients but also address and reduce business fiduciary liability. Together with their partners, CPADD has saved their clients more than $3.5 billion in taxes.

James Jurica

James Jurica embarked on his professional journey in the financial services industry immediately after college and has been dedicated to it ever since. He is passionate about assisting clients in realizing their long-term financial goals. His primary focus lies on the investment management side of financial planning.

James places a strong emphasis on risk management, ensuring that the investment process consistently aims to mitigate risk and volatility in clients’ portfolios while still securing the necessary returns to meet the clients’ objectives.

James holds the Certified Financial Planner CFP® designation, a credential earned by less than 10% of all financial advisors. This advanced training and education allow James to deliver top-tier service and value to his clients. He also holds the Chartered Financial Consultant CHFC®, Chartered Life Underwriter CLU®, and Retirement Income Certified Professional RICP® designations. These additional qualifications have provided James with extensive training and insights into a broad spectrum of financial planning areas.

James is happily married to his wonderful wife, Abbey. They are proud parents of a 2-year-old son and a 1-year-old daughter. The family cherishes their weekends spent together at the lake.

Robert W. Larsen

Bob began his career in the financial services industry in 1965 with the New York Life Insurance Company. In 1967 Bob entered the management ranks of the company and by 1975 had, as General Manager of his agency, led that agency to the top position company-wide.

In 1981 Bob resigned from New York Life and formed the consulting company The Rushmore Group Inc. Based in Newport Beach, California, The Rushmore Group was organized to assist corporate owners and high-net-worth individuals protect their corporate assets and maximize the value of tax strategies using well-proven but not openly known techniques and strategies.

The Rushmore Group research team spends more than twenty-five percent of its time strategizing with men and women across the country with the brightest legal and accounting minds to analyze and understand how to use unique ideas to realize our clients’ dreams.

As a result of the high-level professional relationships and membership in the London-based Society of Trust and Estate Practitioners, also known as T.E.P., the Rushmore Group team, led by Bob, displays a seasoned understanding of the needs of high-net-worth individuals and successful business owners and the strategies that can change the outcome of their life’s work. Bob places a special emphasis on the simplification of complex concepts as they relate to business, family and personal client goals.

Bob has authored and co-authored many publications, such as the article published in the prestigious “Journal of Taxation”, and is frequently asked to speak at national industry events and education seminars for accountants, lawyers and community business leaders.

The Rushmore Group’s high-net-worth clientele reflects our level of expertise and respect and reads like “Who’s Who” in the business and professional communities.

Bob resides in Monarch Beach, California.

Daryl E. Hable

Daryl entered the financial services industry nearly 30 years ago with commercial and corporate banking engagements. For the past 15 years, he has focused on sharing and implementing insurance-based tax strategies with financial, legal and accounting advisors and their clients.

Daryl’s primary focus at The Rushmore Group is sharing advanced insurance-based concepts with our strategic partners. He also conducts the appropriate technical research tailored for each client presentation and manages the preparation of individualized presentation materials for those meetings.

Daryl and his wife, Kiersty, split their time between residences in Irvine, California and Park City, Utah.